Ashley, a calendar year taxpayer, owns 400 shares of Yale Corporation stock that she purchased two years ago for $4,000. In the current year Ashley sells all 400 shares of the Yale Corporation stock for $2,400 on December 27. On January 4 of the following year, Ashley purchases 300 shares of Yale Corporation stock for $800. Ashley's recognized loss and her basis in the newly purchased 300 shares of Yale Corporation stock are

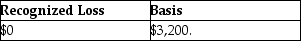

A)

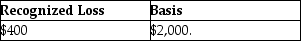

B)

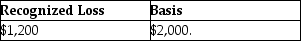

C)

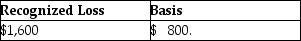

D)

Correct Answer:

Verified

Q96: If property that qualifies as a taxpayer's

Q97: Victor,a calendar-year taxpayer,owns 100 shares of AB

Q110: Samuel,a calendar year taxpayer,owns 100 shares of

Q110: Which of the following individuals is not

Q110: Rob sells stock with a cost of

Q111: Kyle drives a race car in his

Q113: For the years 2011 through 2015 (inclusive)Max,a

Q117: Bart owns 100% of the stock of

Q120: For the years 2011 through 2015 (inclusive)Mary,a

Q135: Abigail's hobby is sculpting.During the current year,Abigail

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents