Dustin purchased 50 shares of Short Corporation for $500. During the current year, Short declared a nontaxable 10% stock dividend. What is the basis per share before and after the stock dividend is distributed?

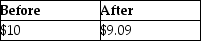

A)

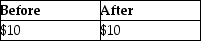

B)

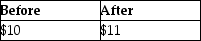

C)

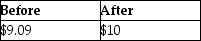

D)

Correct Answer:

Verified

Q30: Interest incurred during the development and manufacture

Q39: Terra Corp. purchased a new enterprise software

Q45: If a nontaxable stock dividend is received

Q48: Monte inherited 1,000 shares of Corporation Zero

Q51: In the current year,Andrew received a gift

Q52: In a common law state,jointly owned property

Q54: Billy and Sue are married and live

Q55: Joycelyn gave a diamond necklace to her

Q56: During the current year,Don's aunt Natalie gave

Q59: Tina purchases a personal residence for $278,000,but

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents