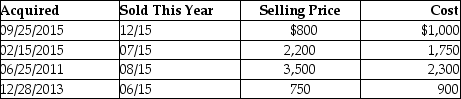

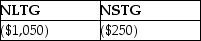

This year, Lauren sold several shares of stock held for investment. The following is a summary of her capital transactions for 2015:  What are the amounts of Lauren's capital gains (losses) for this year?

What are the amounts of Lauren's capital gains (losses) for this year?

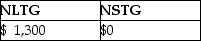

A)

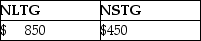

B)

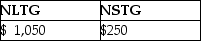

C)

D)

Correct Answer:

Verified

Q64: Taxpayers who own mutual funds recognize their

Q65: All of the following are capital assets

Q70: Emma Grace acquires three machines for $80,000,which

Q83: Nate sold two securities in 2015:

Q84: Renee is single and has taxable income

Q87: Gertie has a NSTCL of $9,000 and

Q90: The taxable portion of a gain from

Q90: Darla sold an antique clock in 2015

Q95: If the taxpayer's net long-term capital losses

Q100: To be considered a Section 1202 gain,the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents