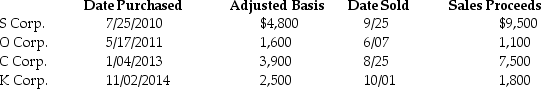

Mike sold the following shares of stock in 2015:  What are the tax consequences of these transactions, assuming his marginal tax rate is (a) 33% and (b) 39.6%? Ignore the medicare tax on net investment income.

What are the tax consequences of these transactions, assuming his marginal tax rate is (a) 33% and (b) 39.6%? Ignore the medicare tax on net investment income.

Correct Answer:

Verified

Q101: Melanie,a single taxpayer,has AGI of $220,000 which

Q103: Purchase of a bond at a significant

Q110: Corporate taxpayers may offset capital losses only

Q110: Jade is a single taxpayer in the

Q115: Stock purchased on December 15,2014,which becomes worthless

Q117: Niral is single and provides you with

Q120: On January 31 of this year,Jennifer pays

Q130: The gain or loss on an asset

Q133: A taxpayer owns 200 shares of stock

Q643: What type of property should be transferred

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents