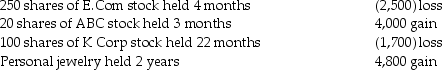

Trista, a taxpayer in the 33% marginal tax bracket sold the following capital assets this year:  What is the amount of and nature of (LT or ST) capital gain or loss? Be specific as to the rates at which gains, if any, are taxed.

What is the amount of and nature of (LT or ST) capital gain or loss? Be specific as to the rates at which gains, if any, are taxed.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q101: Melanie,a single taxpayer,has AGI of $220,000 which

Q103: Purchase of a bond at a significant

Q107: Amanda,whose tax rate is 33%,has NSTCL of

Q108: Galvin Corporation has owned all of the

Q109: Max sold the following capital assets this

Q110: Jade is a single taxpayer in the

Q110: Corporate taxpayers may offset capital losses only

Q111: Tina, whose marginal tax rate is 33%,

Q117: Niral is single and provides you with

Q124: Everest Inc.is a corporation in the 35%

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents