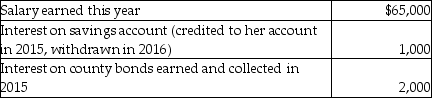

Ms. Marple's books and records for 2015 reflect the following information:  What is the amount Ms. Marple should include in her gross income in 2015?

What is the amount Ms. Marple should include in her gross income in 2015?

A) $66,000

B) $67,000

C) $68,000

D) $65,000

Correct Answer:

Verified

Q44: Norah's Music Lessons Inc.is a calendar year

Q45: Alex is a calendar-year sole proprietor.He began

Q45: Speak Corporation,a calendar year cash basis taxpayer,sells

Q51: Distributions in excess of a corporation's current

Q52: Gains realized from property transactions are included

Q53: XYZ Corporation declares a 10 percent stock

Q54: Qualified dividends received by individuals are taxed

Q54: CT Computer Corporation, an accrual basis taxpayer,

Q57: Interest on the obligations of the U.S.government,states,territories,and

Q57: Gabe Corporation,an accrual-basis taxpayer that uses the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents