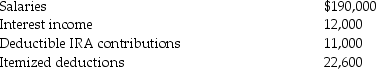

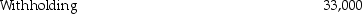

The following information is available for Bob and Brenda Horton, a married couple filing a joint return, for 2015. Both Bob and Brenda are age 32 and have no dependents.

a. What is the amount of their gross income?

a. What is the amount of their gross income?

b. What is the amount of their adjusted gross income?

c. What is the amount of their taxable income?

d. What is the amount of their tax liability (gross tax)?

e. What is the amount of their tax due or (refund due)?

Correct Answer:

Verified

Q1: Taxpayers have the choice of claiming either

Q1: All of the following items are deductions

Q6: Generally,itemized deductions are personal expenses specifically allowed

Q7: Taxable income for an individual is defined

Q10: Although exclusions are usually not reported on

Q11: Bill and Tessa have two children whom

Q11: The standard deduction is the maximum amount

Q12: Nonrefundable tax credits are allowed to reduce

Q13: Nonresident aliens are allowed a full standard

Q15: Refundable tax credits are allowed to reduce

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents