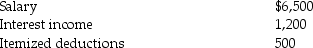

The following information for 2015 relates to Emma Grace, a single taxpayer, age 18:  a. Compute Emma Grace's taxable income assuming she is self-supporting.

a. Compute Emma Grace's taxable income assuming she is self-supporting.

b. Compute Emma Grace's taxable income assuming she is a dependent of her parents.

Correct Answer:

Verified

Q64: To qualify as an abandoned spouse,the taxpayer

Q83: In order to qualify to file as

Q83: Elise,age 20,is a full-time college student with

Q84: Keith,age 17,is a dependent of his parents.During

Q92: Dave,age 59 and divorced,is the sole support

Q93: Liz and Bert divorce and Liz receives

Q98: A building used in a business is

Q100: Satish,age 11,is a dependent of his parents.His

Q105: A corporation has revenue of $350,000 and

Q135: If an individual with a marginal tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents