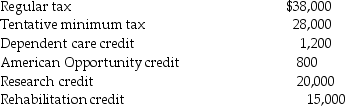

Ivan has generated the following taxes and credits this year:  How much general business credit will he apply to the current year tax liability?

How much general business credit will he apply to the current year tax liability?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q101: Tyne is single and has AGI of

Q101: Sam and Megan are married with two

Q106: Which of the following statements is incorrect

Q109: In 2015 Rita is divorced with one

Q115: Hawaii, Inc., began a child care facility

Q122: Beth and Jay project the following taxes

Q122: If a taxpayer's AGI is greater than

Q123: Nonrefundable personal tax credits are allowed against

Q126: Discuss when Form 6251,Alternative Minimum Tax,must be

Q127: Assume a taxpayer determines that his total

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents