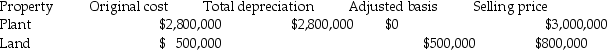

Julie sells her manufacturing plant and land originally purchased in 1980. Accelerated depreciation had been taken on the building, but the building is now fully depreciated. Julie is in the 39.6% marginal tax bracket. Other information is as follows:  She has not sold any other assets this year. A review of her file indicates that the only asset dispositions in the past five years was a truck sold for a $10,000 loss last year. What are the tax consequences of the sale (type of gain; rates at which taxed)?

She has not sold any other assets this year. A review of her file indicates that the only asset dispositions in the past five years was a truck sold for a $10,000 loss last year. What are the tax consequences of the sale (type of gain; rates at which taxed)?

Correct Answer:

Verified

Q41: Unrecaptured 1250 gain is the amount of

Q44: With respect to residential rental property

A)80% or

Q63: In addition to the normal recapture rules

Q64: In 1980,Mr.Lyle purchased a factory building to

Q71: Emily,whose tax rate is 28%,owns an office

Q73: Ross purchased a building in 1985,which he

Q78: Sec.1250 requires a portion of gain realized

Q79: Marta purchased residential rental property for $600,000

Q92: Pam owns a building used in her

Q1729: What is the purpose of Sec. 1245

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents