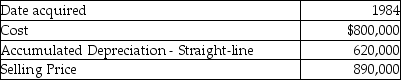

A corporation sold a warehouse during the current year. The straight-line depreciation method was used. Information about the building is presented below:  How much gain should the corporation report as section 1231 gain?

How much gain should the corporation report as section 1231 gain?

A) $124,000

B) $620,000

C) $586,000

D) $710,000

Correct Answer:

Verified

Q65: When appreciated property is transferred at death,the

Q66: Trena LLC,a tax partnership owned equally by

Q80: The additional recapture under Sec.291 is 25%

Q81: Costs of tangible personal business property which

Q82: Gain recognized on the sale or exchange

Q84: Douglas bought office furniture two years and

Q86: Maura makes a gift of a van

Q93: If no gain is recognized in a

Q100: Describe the tax treatment for a noncorporate

Q106: Pete sells equipment for $15,000 to Marcel,his

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents