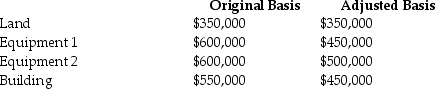

Describe the tax treatment for a noncorporate taxpayer in the 39.6% marginal tax bracket who sells each of the first two assets for $500,000 and each of the second two assets for $750,000. Each asset was purchased in 2011 and is used in a trade or business. There are no other gains and losses and no nonrecaptured Section 1231 losses.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q66: Trena LLC,a tax partnership owned equally by

Q81: Costs of tangible personal business property which

Q84: Douglas bought office furniture two years and

Q89: An individual taxpayer sells a business building

Q93: If no gain is recognized in a

Q96: A corporation sold a warehouse during the

Q103: Melissa acquired oil and gas properties for

Q106: Pete sells equipment for $15,000 to Marcel,his

Q107: Jacqueline dies while owning a building with

Q108: Cobra Inc.sold stock for a $25,000 loss

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents