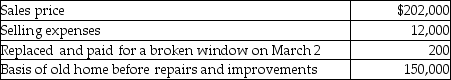

Frank, a single person age 52, sold his home this year. He had lived in the house for 10 years. He signed a contract on March 4 to sell his home and closed the sale on May 3.  Based on these facts, what is the amount of his recognized gain?

Based on these facts, what is the amount of his recognized gain?

A) $0

B) $39,800

C) $40,000

D) $52,000

Correct Answer:

Verified

Q61: According to Sec.121,individuals who sell or exchange

Q62: If a principal residence is sold before

Q75: The $250,000/$500,000 exclusion for gain on the

Q77: A loss on the sale of a

Q82: Theresa owns a yacht that is held

Q83: Bob and Elizabeth,both 55 years old and

Q88: In order for the gain on the

Q92: Luke's offshore drilling rig with a $700,000

Q94: On May 1 of this year,Ingrid sold

Q1872: May a taxpayer elect under Sec. 1033

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents