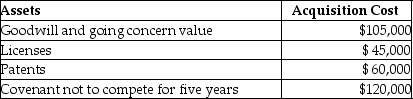

On January 1, 2015, Charlie Corporation acquires all of the net assets of Rocky Corporation for $2,000,000. The following intangible assets are included in the purchase agreement:  What is the total amount of amortization allowed in 2015?

What is the total amount of amortization allowed in 2015?

A) $15,000

B) $22,000

C) $31,000

D) $38,000

Correct Answer:

Verified

Q69: Taxpayers are entitled to a depletion deduction

Q72: Off-the-shelf computer software that is purchased for

Q80: A taxpayer owns an economic interest in

Q82: Jimmy acquires an oil and gas property

Q83: Intangible drilling and development costs (IDCs)may be

Q88: In accounting for research and experimental expenditures,all

Q88: In calculating depletion of natural resources each

Q92: Stellar Corporation purchased all of the assets

Q101: Maria,a sole proprietor,has several items of office

Q105: Kenrick is an employee of the Theta

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents