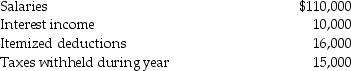

Brad and Angie had the following income and deductions during 2015:  Calculate Brad and Angie's tax liability due or refund, assuming that they have 2 personal exemptions. They file a joint tax return.

Calculate Brad and Angie's tax liability due or refund, assuming that they have 2 personal exemptions. They file a joint tax return.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q41: Jillian,a single individual,earns $230,000 in 2015 through

Q50: Organizing a corporation as an S Corporation

Q55: Which of the following is not one

Q60: In a limited liability partnership,a partner is

Q68: In an S corporation,shareholders

A)are taxed on their

Q69: Rocky and Charlie form RC Partnership as

Q77: All of the following are classified as

Q79: What is an important aspect of a

Q83: The term "tax law" includes

A)Internal Revenue Code.

B)Treasury

Q2216: During the current tax year, Frank Corporation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents