Use the following to answer questions .

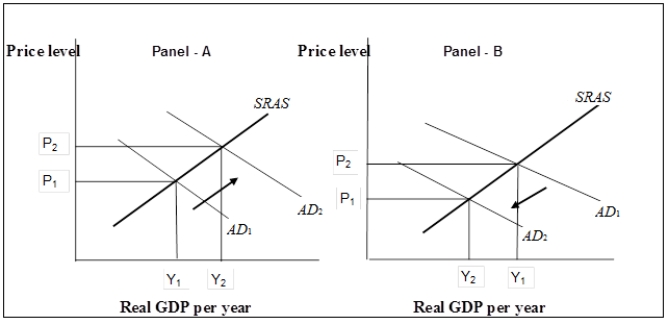

Exhibit: The Money Supply and Aggregate Demand

-(Exhibit: The Money Supply and Aggregate Demand) If the economy is experiencing an inflationary gap, the Fed would

A) buy government bonds, which would increase the money supply and decrease interest rates. The results of such a policy are represented in Panel (a) .

B) sell government bonds, which would decrease the money supply and increase interest rates. The results of such a policy are represented in Panel (b) .

C) buy government bonds, which would decrease the money supply and increase interest rates. The results of such a policy are represented in Panel (b) .

D) sell government bonds, which would increase the money supply and increase interest rates. The results of such a policy are represented in Panel (b) .

Correct Answer:

Verified

Q96: What happens in the money market when

Q97: The supply curve of money shows, all

Q98: Use the following to answer questions.

Exhibit: The

Q99: Which of the following increases the demand

Q100: If financial investors believe that the prices

Q102: An increase in interest rates due to

Q103: Use the following to answer questions .

Exhibit:

Q104: If the Fed acts to decrease the

Q105: If the Fed acts to increase the

Q106: All other things unchanged, why does an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents