Use the following to answer questions .

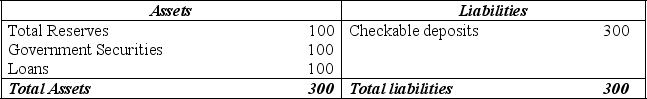

Exhibit: Reserves, Loans, and Money

-(Exhibit: Reserves, Loans, and Money) If the required reserve ratio is 10% and the market interest rate is 8%, what is Bolton Bank's opportunity cost of holding the excess reserves it is currently holding?

A) $5.6 million

B) $3.2 million

C) $0.8 million

D) 0; Bolton Bank has no excess reserves.

Correct Answer:

Verified

Q107: Suppose the required reserve ratio is 10%.

Q108: Use the following to answer questions .

Exhibit:

Q109: Use the following to answer questions .

Exhibit:

Q110: Use the following to answer questions .

Exhibit:

Q111: Use the following to answer questions .

Exhibit:

Q113: Use the following to answer questions .

Exhibit:

Q114: Use the following to answer questions .

Exhibit:

Q115: Which of the following is true regarding

Q116: Use the following to answer questions .

Exhibit:

Q117: Use the following to answer questions .

Exhibit:

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents