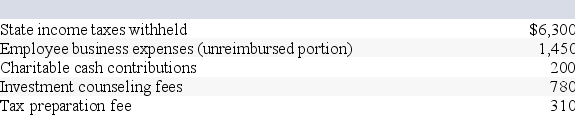

Toshiomi works as a sales representative and travels extensively for his employer's business.This year Toshiomi was paid $75,000 in salary and made the following expenditures:

Toshiomi also made a number of trips to Las Vegas for gambling.This year Toshiomi won $12,000 in a poker tournament and this amount was almost enough to offset his other gambling losses ($13,420).Calculate Toshiomi's 2019 taxable income if he files single.

Toshiomi also made a number of trips to Las Vegas for gambling.This year Toshiomi won $12,000 in a poker tournament and this amount was almost enough to offset his other gambling losses ($13,420).Calculate Toshiomi's 2019 taxable income if he files single.

Correct Answer:

Verified

$68,500 = ($75,000 salary + $12...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q56: Campbell, a single taxpayer, has $400,000 of

Q57: Bryan is 67 years old and lives

Q58: Which of the following is a true

Q60: Rochelle, a single taxpayer (age 47), has

Q64: Rachel is an engineer who practices as

Q65: Rachel is an engineer who practices as

Q66: Rachel is an accountant who practices as

Q106: Cesare is 16 years old and works

Q111: This year Kelly bought a new auto

Q114: Claire donated 200 publicly traded shares of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents