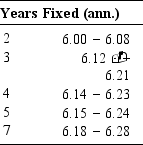

A swap dealer provides the following quotations for a yen/$ currency swap. The quotes are for a yen fixed rate against the U.S. Treasury yield flat, with annual payments.

A client wishes to enter a five-year swap, paying yen and receiving $. The current yield on five-year U.S. Treasury bonds is 7.20%, using the semiannual method, which amounts to 7.33%, using the annual European method.

A client wishes to enter a five-year swap, paying yen and receiving $. The current yield on five-year U.S. Treasury bonds is 7.20%, using the semiannual method, which amounts to 7.33%, using the annual European method.

What will the exact terms of the swap be if the client accepts these quotations?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: To capitalize on your expectation of a

Q4: A German investor holds a portfolio

Q5: Derive a theoretical price for each

Q6: A few years ago when the

Q7: An Italian corporation enters into a

Q9: You specialize in arbitrage between the futures

Q10: In Hong Kong, the size of

Q11: A money manager holds $50 million worth

Q12: Let's consider a Swiss franc futures

Q13: Pouf is a rapidly growing and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents