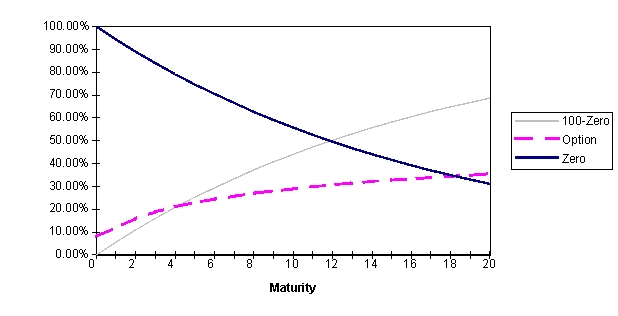

You're a banker. A client wishes to buy a guaranteed note with a 100% indexation to the stock index's growth. In other words, he doesn't want any coupon but requires 100% of the index growth. You wonder about the maturity of such a note. You check the prices of various index calls traded on the market for different maturities. Their strike is the current index level and their price is expressed as a percentage of this level. (For instance if the CAC is worth 3,000, the strike is 3,000 and the one-year maturity call trades at 11% of 3,000. You also check the price of a zero-coupon in percentage for various maturities. The following graph shows, for each maturity, the price of the option, that of the zero-coupon, and 100%-zero.  a. What is the maturity of the guaranteed note (coupon =0%, indexation =100%)? Justify.

a. What is the maturity of the guaranteed note (coupon =0%, indexation =100%)? Justify.

b. If as a banker, you want to make a profit, should you lengthen or shorten the maturity of that note? Explain why.

c. Everything remaining constant (that is, same volatility and interest rate), should the maturity of the guaranteed note be shorter or longer if the index pays a low dividend rather than a high one? Why?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q36: You would like to protect your portfolio

Q37: A five-year currency swap involves two AAA

Q38: A small Dutch bank has the

Q39: A traditional interest rate swap has

Q40: LTCM observed the following ten-year swap spreads

Q42: Titi, a Japanese company, issued a

Q43: Guaranteed note.

You are a young banker offering

Q44: Strumpf Ltd. decides to issue a convertible

Q45: Digital options: Digital (or binary) options

Q46: The Kingdom of Papou issues a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents