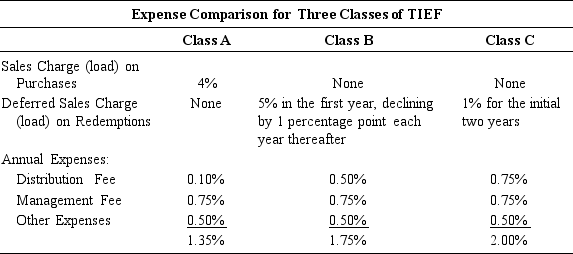

An investor is considering the purchase of Tata International Equity Fund (TIEF) for his portfolio. Like many U.S.-based mutual funds today, TIEF has more than one class of shares. Although all classes hold the same portfolio of securities, each class has a different expense structure. This particular mutual fund has three classes of shares: A, B, and C. The expenses of these classes are summarized in the following table:

The time horizon associated with the investor's objective in purchasing TIEF is three years; he decides to specify it as just over three years. He expects equity investments with risk characteristics similar to TIEF to earn 10% per year, and he decides to make his selection of fund share class based on an assumed 10% return each year, gross of any of the expenses given in the table above.

The time horizon associated with the investor's objective in purchasing TIEF is three years; he decides to specify it as just over three years. He expects equity investments with risk characteristics similar to TIEF to earn 10% per year, and he decides to make his selection of fund share class based on an assumed 10% return each year, gross of any of the expenses given in the table above.

Based on only the above information, determine the class of shares that is most appropriate for this investor. Assume that expense percentages given will be constant at the given values. Assume that the deferred sales charges are computed on the basis of net asset value (NAV).

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: A hedge fund has a capital of

Q5: Survivorship bias is a serious potential problem

Q6: G.O. Bug wants to invest $12,000

Q7: Let's assume that you are a

Q8: An investor wants to evaluate an

Q9: A hedge fund currently has assets of

Q11: An analyst is evaluating a real estate

Q12: A real estate company has prepared

Q13: The SOL Group specializes in hedge

Q14: Exchange traded funds (ETFs) are usually considered

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents