Fundamental Value Based on Absolute PPP. Ideally, one would like to compare directly the price

of goods in two countries to see if an exchange rate conforms to absolute PPP, or whether it is overvalued or undervalued in real terms. As mentioned in Chapter 2, this can only be done for some individual goods that are clearly comparable ("law of one price"), and the estimation for different goods can lead to opposing conclusions. In Chapter 2, we provide an analysis based on the well-known Big Mac report of The Economist. Of course, the Big Mac is a very particular product and a fundamental PPP value can be computed on a wide range of products. The results are often conflicting. For example, one can look at production prices rather than consumption prices. Some studies are conducted by looking at labor costs. Rather than looking at unit labor costs for unskilled workers, as is often done, the exhibit below reports the average annual remuneration of the chief executive officer (CEO) of industrial companies with annual revenues of $250 million to $500 million in ten selected areas of the world. The figures are also from April 1998. They include all forms of compensation, such as bonuses, perks, and stock options, but are not adjusted for different taxes or costs of living.

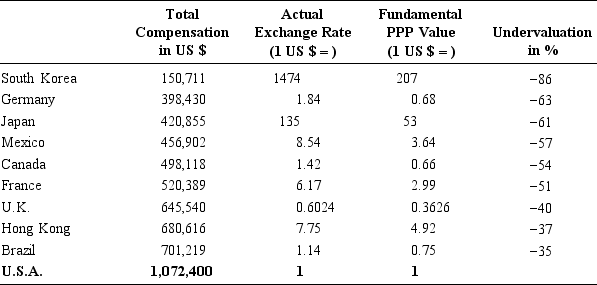

The first column gives the total CEO compensation measured in U.S. dollars using the actual exchange rate, which is indicated in the second column. The third column gives the fundamental PPP value of each currency, implied by the national CEO compensations. It is the exchange rate with the dollar that would make CEO compensation identical in all countries. The fourth column gives the actual overvaluation (if positive) or undervaluation (if negative) of the local currency relative to its fundamental value in terms of CEO compensation.

EXHIBIT: Determining a Fundamental PPP Value Based on CEOs' Remuneration

Source: Total compensation data comes from Towers Perrin, 1998.

Source: Total compensation data comes from Towers Perrin, 1998.

What conclusions can you draw from this exhibit?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: In 1994, the United States was experiencing

Q3: The spot exchange rate is CHF/$ =2.00.

Q4: The exhibit below presents the 1997 balance

Q5: Should nominal interest rates be equal across

Q7: Exchange Rate Dynamics. Britain and Europe have

Q9: Here are some statistics:

Q10: The ¥/€ spot exchange rate is 130

Q11: The current Swiss franc/U.S. dollar spot exchange

Q12: The Japanese balance of payments from 1994

Q13: Under a system of fixed exchange rates,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents