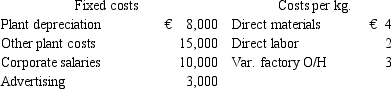

Francois French manufactures cheese,which he normally sells at €20/kg,on which sales commission of 5% is paid.Plant capacity is 7,500 kg/month.Income tax is levied at 30%.  If sales are 5,000 kgs,which of the following is true?

If sales are 5,000 kgs,which of the following is true?

A) Total contribution margin is €50,000

B) Ratio of total contribution margin to net income before taxes is 3.57

C) Taxes payable are €4,200

D) Operating leverage is 42%

E) All of the above

Correct Answer:

Verified

Q2: Hardley sells mamburgers.He faces fixed

Q3: Pamela in Bamplona makes bull-repellent scent

Q4: Opportunity Costs:

A)must never be negative

B)may be found

Q5: Francois French manufactures cheese,which he normally

Q6: John invested $12,000 in the stock

Q7: The Mojave Water Agency (MWA)sets water policy

Q8: Francois French manufactures cheese,which he normally

Q9: Bertie's Burritos,a fast food enterprise,wants

Q10: Which of the following can be an

Q11: Pamela in Bamplona makes bull-repellent scent

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents