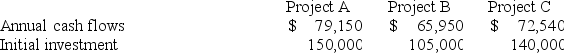

Iron,Inc. ,which has a hurdle rate of 10%,is considering three different independent investment opportunities.Each project has a five-year life.The annual cash flows and initial investment for each of the projects are as follows: (Future Value of $1,Present Value of $1,Future Value Annuity of $1,Present Value Annuity of $1. ) (Use appropriate factor from the PV tables.Do not round intermediate calculations.Round your final answer to the nearest hundred. )  In what order should Iron prioritize investment in the projects?

In what order should Iron prioritize investment in the projects?

A) A,C,B

B) B,C,A

C) A,B,C

D) B,A,C

Correct Answer:

Verified

Q79: Byron Corp.is considering the purchase of a

Q80: Newport Corp.is considering the purchase of a

Q81: A problem in which you must calculate

Q82: A problem in which you must calculate

Q83: Ironwood,Inc. ,which has a hurdle rate of

Q85: How much would you need to deposit

Q86: Boxwood,Inc.is considering three different independent investment opportunities.The

Q87: Carol,Inc.is considering three different independent investment opportunities.The

Q88: Your grandmother has told you she can

Q89: You are saving for a car that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents