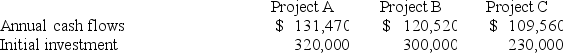

Norwood,Inc. ,which has a hurdle rate of 12%,is considering three different independent investment opportunities.Each project has a seven-year life.The annual cash flows and initial investment for each of the projects are as follows:

a.What is the present value of the annual cash flows for each of the three projects?

a.What is the present value of the annual cash flows for each of the three projects?

b.What is the net present value of each of the projects?

c.What is the profitability index of each of the projects? (Round to two decimal places. )

d.In what order should Norwood prioritize investment in the projects?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q103: Grady Corp.is considering the purchase of a

Q104: Emerson Corp.is trying to decide whether to

Q105: Fire Corp.is considering the purchase of a

Q106: Briar Corp.is considering the purchase of a

Q107: You invest $13,420 in an annuity contract

Q109: Dobson Corp.is considering the purchase of a

Q110: Fargo Corp.is considering the purchase of a

Q111: York Inc.is trying to decide whether to

Q112: Clyde Corp.is considering the purchase of a

Q113: Surf Corp.is considering the purchase of a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents