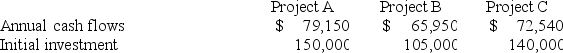

Carmen,Inc. ,which has a hurdle rate of 10%,is considering three different independent investment opportunities.Each project has a five-year life.The annual cash flows and initial investment for each of the projects are as follows:

a.What is the present value of the annual cash flows for each of the three projects?

a.What is the present value of the annual cash flows for each of the three projects?

b.What is the net present value of each of the projects?

c.What is the profitability index of each of the projects? (Round to two decimal places. )

d.In what order should Carmen prioritize investment in the projects?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q116: A problem in which you must calculate

Q117: How much would you need to deposit

Q118: You will need at least $5,000 in

Q119: Cloud Corp.is considering the purchase of a

Q120: Major Corp.is considering the purchase of a

Q121: You want to invest $10,000 in a

Q122: An acquaintance of yours owes you $1,000,but

Q123: You won the lottery,and the jackpot was

Q124: You are saving for a car and

Q125: Imagine you are a managerial accountant in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents