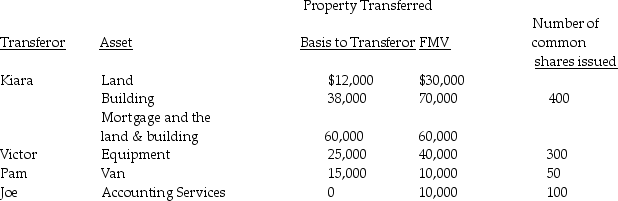

On May 1 of the current year, Kiara, Victor, Pam, and Joe form Newco Corporation with the following investments:

Kiara purchased the land and building several years ago for $12,000 and $50,000, respectively. Kiara has claimed straight-line depreciation on the building. Victor also received a Newco Corporation note for $10,000 due in three years. The note bears interest at a rate acceptable to the IRS. Victor purchased the equipment three years ago for $50,000. Pam also receives $5,000 cash. Pam purchased the van two years ago for $20,000.

Kiara purchased the land and building several years ago for $12,000 and $50,000, respectively. Kiara has claimed straight-line depreciation on the building. Victor also received a Newco Corporation note for $10,000 due in three years. The note bears interest at a rate acceptable to the IRS. Victor purchased the equipment three years ago for $50,000. Pam also receives $5,000 cash. Pam purchased the van two years ago for $20,000.

a) Does the transaction satisfy the requirements of Sec. 351?

b) What are the amounts and character of the reorganized gains or losses to Kiara, Victor, Pam, Joe, and Newco Corporation?

c) What is each shareholder's basis for his or her Newco stock? When does the holding period for the stock begin?

d) What is Newco Corporation's basis for its property and services? When does its holding period begin for each property?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q66: Maria has been operating a business as

Q70: Identify which of the following statements is

Q74: Lynn transfers land having a $50,000 adjusted

Q77: The transferee corporation's basis in property received

Q80: Mario and Lupita form a corporation in

Q83: What is the impact on a transferor

Q85: Dan transfers property with an adjusted basis

Q88: Anton, Bettina, and Caleb form Cage Corporation.

Q89: This year, John, Meg, and Karen form

Q92: Abby owns all 100 shares of Rent

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents