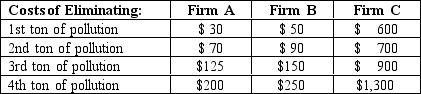

Exhibit 31-3

-Refer to Exhibit 31-3.Suppose that Firms A,B,and C are the only polluters in the state and that each emits 4 tons of pollution into the atmosphere.To cut the level of pollution the government imposes an emission tax of $300 per ton of pollution. As a result of this tax,Firm A would _________________,firm B would ____________________ and firm C would __________________.

A) not reduce any of its pollution; not reduce any of its pollution; reduce all 4 tons of its pollution

B) reduce all 4 tons of its pollution; only reduce 1 ton of its pollution; not reduce any of its pollution

C) reduce all 4 tons of its pollution; reduce all 4 tons of its pollution; not reduce any of its pollution

D) not reduce any of its pollution; reduce 3 tons of its pollution; reduce all 4 tons of its pollution

Correct Answer:

Verified

Q63: A _ good is one that once

Q83: Exhibit 31-3 Q84: If a positive externality exists,_ for the Q85: Exhibit 31-3 Q87: A negative externality exists when Q91: The government's provision of nonexcludable public goods Q93: A negative externality exists when Q105: It is argued that the market will Q111: The excludability versus nonexcludability issue is Q115: A nonexcludable public good is

![]()

![]()

A)a person's or

A)marginal social costs

A)not

A)relevant to

A)nonrivalrous in consumption.

B)rivalrous

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents