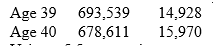

ABC Life Insurance Company is offering a new product.The product is a two-year term insurance policy funded by a single premium at the start of the first year.Death claims are paid at the end of the year in which death occurs.A portion of the appropriate mortality table is shown below.The first number is age,the second is the number alive at the start of the year,and the last number is the number dying during the year.

Using a 5.5 percent interest rate,the present value of $1 one year from today is .9479,and the present value of $1 two years from today is .8985.Assuming a 5.5 percent interest rate,what is the net single premium for a $1,000 two-year term policy issued at age 39?

A) $1.49

B) $2.94

C) $5.67

D) $12.83

Correct Answer:

Verified

Q36: Carl and Carol Williams,a married couple,are doing

Q37: Purposes of life insurance policy reserves include

Q38: Life insurance policy reserves

A)are always equal to

Q39: Which of the following statements is (are)true

Q40: All of the following statements about the

Q42: The gross premium for life insurance is

Q43: The net single premium for a life

Q44: The net premiums collected by a life

Q45: The average annual rate of return on

Q46: According the 2001 CSO mortality table,the yearly

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents