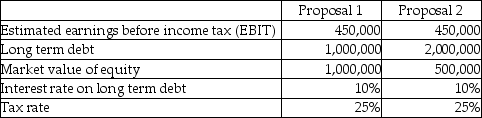

Blue Corp is in the process of acquiring another business.In light of the acquisition,shareholders are currently re-evaluating the appropriateness of the firm's capital structure (the types of and relative levels of debt and equity).The two proposals being contemplated are detailed below:

Requirements

Requirements

a.Calculate the estimated return on equity (ROE)under the two proposals.(ROE ~ net income after taxes / market value of equity; net income after taxes = (EBIT - interest on long-term debt)× (I - tax rate).)

b.Which proposal will generate the higher estimated ROE?

c.What is the primary benefit of leveraging an investment decision? What are two drawbacks to leveraging an investment decision?

Correct Answer:

Verified

Q14: What is a bond indenture?

A)Guarantee of the

Q15: Bank Buy Inc.is in the process of

Q16: Which statement is correct about financial leverage?

A)Leverage

Q17: Which statement best explains the concept of

Q18: Why do bonds often include covenants?

A)To reduce

Q20: Which statement is correct about the financial

Q21: What are positive and negative covenants? Give

Q22: What are "serial bonds"?

A)Bonds that are seldom

Q23: How should non-current financial liabilities be recorded

Q24: When will bonds sell without a premium

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents