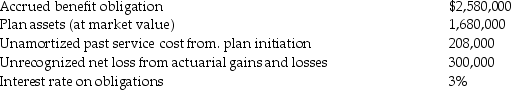

AMA Corporation has a defined benefit pension plan. At January 1,2010,the following balances exist:

For the year ended December 31,2010,the current service cost as determined by an appropriate actuarial cost method was $280,000. A change in actuarial assumptions created a gain of$16,000 in 2010. The expected return on plan assets was $67,200; however,the actual return is $63,700. The expected period of full eligibility at January 1,2010 (i.e.,the vesting period)is 8 years,while the expected average remaining service life is 28 years. AMA paid $227,700 to the pension trustee in December 2010. The company recognizes only the minimum amount of corridor amortization.

For the year ended December 31,2010,the current service cost as determined by an appropriate actuarial cost method was $280,000. A change in actuarial assumptions created a gain of$16,000 in 2010. The expected return on plan assets was $67,200; however,the actual return is $63,700. The expected period of full eligibility at January 1,2010 (i.e.,the vesting period)is 8 years,while the expected average remaining service life is 28 years. AMA paid $227,700 to the pension trustee in December 2010. The company recognizes only the minimum amount of corridor amortization.

Requirement:

Prepare the journal entry to record pension expense for 2010.

Correct Answer:

Verified

Q41: Current service cost for a defined benefit

Q43: A company's defined benefit pension plan incurs

Q47: A company has a defined benefit pension

Q48: A company's defined benefit pension plan incurs

Q50: A company has a defined benefit pension

Q55: Current service cost for a defined benefit

Q61: Reagan Air Conditioning Company has three pension

Q63: What amount is included in the pension

Q65: Which statement is not correct?

A)If an enterprise

Q66: What is an actuarial loss?

A)An unfavourable difference

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents