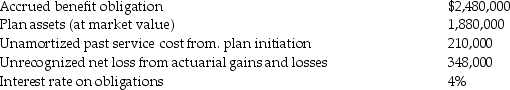

Axel Corporation has a defined benefit pension plan. At January 1,2012,the following balances exist:

For the year ended December 31,2012,the current service cost as determined by an appropriate actuarial cost method was $265,000. A change in actuarial assumptions created a gain of $16,000 in 2012. The expected return on plan assets was $65,200; however,the actual return is $63,700. The expected period of full eligibility at January 1,2012 (i.e.,the vesting period)is 10 years,while the expected average remaining service life is 20 years. Axel paid $220,700 to the pension trustee in December 2012. The company recognizes only the minimum amount of corridor amortization.

For the year ended December 31,2012,the current service cost as determined by an appropriate actuarial cost method was $265,000. A change in actuarial assumptions created a gain of $16,000 in 2012. The expected return on plan assets was $65,200; however,the actual return is $63,700. The expected period of full eligibility at January 1,2012 (i.e.,the vesting period)is 10 years,while the expected average remaining service life is 20 years. Axel paid $220,700 to the pension trustee in December 2012. The company recognizes only the minimum amount of corridor amortization.

Requirement:

Prepare the journal entry to record pension expense for 2012.

Correct Answer:

Verified

Q22: What are actuarial losses or gains in

Q44: What are past service costs in a

Q45: A company has a defined benefit pension

Q46: A company has a defined benefit pension

Q49: At the beginning of the current year,a

Q51: A company reported $430,000 of pension expense

Q52: A company has a defined benefit pension

Q58: Current service cost for a defined benefit

Q59: A company's defined benefit pension plan incurs

Q60: A company has a defined benefit pension

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents