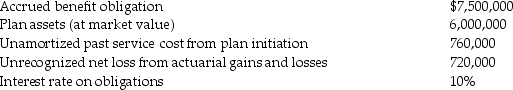

Cup of Joe Corporation provides its employees with a defined benefit pension plan. As of January 1,2011,the following balances exist:

For the year ended December 31,2011,the current service cost,as determined by an appropriate actuarial cost method,was $440,000. A change in actuarial assumptions created a loss of $12,000 in 2011. The expected return on plan assets was $360,000.

For the year ended December 31,2011,the current service cost,as determined by an appropriate actuarial cost method,was $440,000. A change in actuarial assumptions created a loss of $12,000 in 2011. The expected return on plan assets was $360,000.

However,the actual return is $341,000. The expected period of full eligibility at January 1,2011 (i.e.,the vesting period)is 10 years,while the expected average remaining service life is 15 years. Cup of Joe paid $996,000 to the pension trustee in December 2010. The company recognizes only the minimum amount of corridor amortization.

Requirement:

Calculate the pension expense for 2011 and determine the carry forward amount for unrecognized actuarial gains or losses at the end of 20ll.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q64: Humid Furnishings produces quality household furniture.The company

Q69: Which statement is correct?

A)The defined benefit liability

Q71: What amount will be presented on the

Q71: Which statement best explains the "corridor limit"?

A)This

Q75: Odakota Canoes has had a defined benefit

Q77: Humming Furnishings produces quality household furniture.The company

Q77: What amount will be presented on the

Q78: Which statement is correct for the treatment

Q79: What is an actuarial gain?

A)An unfavourable difference

Q91: Explain the underlying rationale for the "corridor

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents