The following data represent the differences between accounting and tax income for Seafood Imports Inc.,whose pre-tax accounting income is $650,000 for the year ended December 31. The company's income tax rate is 45%. Additional information relevant to income taxes includes the following.

a. Capital cost allowance of $270,000 exceeded accounting depreciation expense of $160,000 in the current year.

b. Rents of $25,000,applicable to next year,had been collected in December and deferred for financial statement purposes but are taxable in the year received.

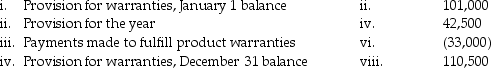

c. In a previous year,the company established a provision for product warranty expense. A summary of the current year's transactions appears below:

For tax purposes,only actual amounts paid for warranties are deductible.

For tax purposes,only actual amounts paid for warranties are deductible.

d. Insurance expense to cover the company's executive officers was $6,800 for the year,and you have determined that this expense is not deductible for tax purposes.

Requirement:

Prepare the journal entries to record income taxes for Seafood Imports.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q36: What is the deferred tax liability under

Q37: Which of the following is an example

Q37: Under the accrual method,what is the effect

Q38: Under the accrual method,what is the effect

Q39: How much tax expense would be recorded

Q41: At the beginning of the current fiscal

Q42: For each of the following differences between

Q43: The following summarizes information relating to Gonzalez

Q51: What is a deferred tax asset?

A)A deductible

Q53: What is an "originating difference"?

A)The net carrying

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents