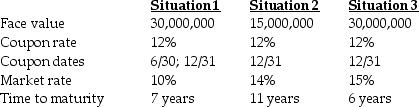

There are three independent situations summarized below. In all three cases the bonds are sold on January 1,2011 and the issuing company has a December 31 year-end. In situation three,the bonds were all repurchased at par on January 1,2015.

Requirement:

Requirement:

Prepare journal entries to record:

a. The issuance of the three bonds.

b. Payment of interest and related amortization on December 31,2011. Prepare the amortization table to help you.

c. Retirement of the situation 3 bond on January 1,2015.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q47: Ginny Inc.sold $800,000 of two-year bonds for

Q60: On June 1,2012,ABC LTD.provides a vendor with

Q62: Fredericton Aerospace Inc.raised $5,369,210 by selling $5,000,000

Q67: On May 1,2014,SBC INC.buys a photocopier listed

Q69: Explain what an "in-substance defeasance" is and

Q75: Which statement is correct about the derecognition

Q80: When can a non-current liability not be

Q83: Which standard does not need to be

Q83: On July 1,2014,Club Country Golf Corp. issued

Q85: Sarah Braun is the owner of Sarah's

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents