On July 1,2014,Club Country Golf Corp. issued $20,000,000 of five-year,12%,semi-annual bonds for $20,075,000. At time of issue,Club Country paid its investment bank a $75,000 sales commission. On July 31,2017,Club Country calls $12,000,000 of the bonds,paying 104 plus accrued interest,and retires them. On March 31,2018,Club Country purchases the remaining bonds on the open market for $8,180,000 including accrued interest and retires them. Club Country's year-end is August 31. The company does not use reversing entries.

Requirements:

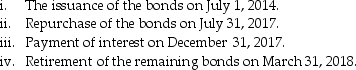

a. Prepare journal entries to record:

b. Provide a brief explanation as to the most likely reasons that Club Country was able to repurchase its bonds at a discount.

b. Provide a brief explanation as to the most likely reasons that Club Country was able to repurchase its bonds at a discount.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q47: Ginny Inc.sold $800,000 of two-year bonds for

Q60: On June 1,2012,ABC LTD.provides a vendor with

Q62: Fredericton Aerospace Inc.raised $5,369,210 by selling $5,000,000

Q67: On May 1,2014,SBC INC.buys a photocopier listed

Q69: Explain what an "in-substance defeasance" is and

Q75: Which statement is correct about the derecognition

Q80: When can a non-current liability not be

Q81: There are three independent situations summarized below.

Q83: Which standard does not need to be

Q85: Sarah Braun is the owner of Sarah's

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents