Sarah Braun is the owner of Sarah's Shameless Boutique Corp. (SSBC),a newly incorporated company. Sarah believes that she has a great concept but does not have a lot of money to start the business. Sarah is fairly resourceful,though,and has been able to arrange the following:

1. On July 1,2014,SSBC provides a vendor with a $18,500 non-interest-bearing note due on July 1,2015 in exchange for furniture with a list price of $18,100. Sarah Braun guarantees the debt.

2. On August 1,2014,SSBC buys a photocopier listed for $2,600. The office supply store agrees to accept a $800 down payment and a $2,100,three-year note payable at $798 per year including interest at 7% with the first payment due on August 1,2015. The loan is secured by a lien on the photocopier.

3. On September 1,2014,SSBC borrows $15,000 from its bank for working capital purposes. The loan,plus interest at 12% per annum,is due on June 30,2015. SSBC grants the bank a security interest in its accounts receivables and inventory.

Unfortunately,SSBC's target audience is a bit more prudish than she anticipated and sales have been slow. While the company was able to retire the bank loan on the due date,it had insufficient cash to pay off the furniture loan. The vendor agrees to accept 2,000 common shares in SSBC in settlement of the obligation. Sarah believed that the shares are worth $20 each,but as this was the first time that SSBC had issued shares to anyone other than Sarah,a fair market price was not yet established.

SSBC's year-end is June 30. The company's banker has suggested that an appropriate market rate for SSBC is 12% per annum for loans that mature in one year or less and 14% for loans with longer maturities.

Required:

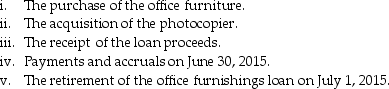

a. Prepare journal entries to record:

b. Briefly describe the note disclosure that would be required with respect to the foregoing liabilities.

b. Briefly describe the note disclosure that would be required with respect to the foregoing liabilities.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q47: Ginny Inc.sold $800,000 of two-year bonds for

Q60: On June 1,2012,ABC LTD.provides a vendor with

Q62: Fredericton Aerospace Inc.raised $5,369,210 by selling $5,000,000

Q67: On May 1,2014,SBC INC.buys a photocopier listed

Q69: Explain what an "in-substance defeasance" is and

Q75: Which statement is correct about the derecognition

Q80: When can a non-current liability not be

Q81: There are three independent situations summarized below.

Q83: On July 1,2014,Club Country Golf Corp. issued

Q83: Which standard does not need to be

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents