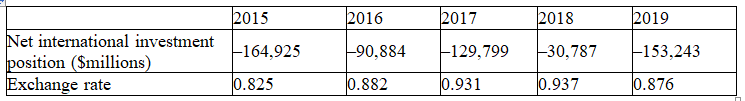

Suppose we measure Canada's net capital outflow by what Statistics Canada calls "net international investment position," and we approximate the real exchange rate of the dollar by the price of the Canadian dollar in terms of U.S. dollars. The following table gives some fictitious data on these two variables.

a. What does our open-economy macroeconomic model predict with regard to the relationship between net capital outflow and the real exchange rate?

b. Do you find evidence in the data to support the theory?

c. If you find discrepancies between the data and the theory, what could cause them?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q105: How are the identities S = NCO

Q182: Using the macroeconomic model studied, analyze the

Q183: Using the macroeconomic model of a foreign-currency

Q184: Suppose that the Romanian government budget deficit

Q185: Explain how the relation between the real

Q186: Suppose that the world consists of only

Q188: Suppose the Canadian government institutes a "Buy

Q189: Suppose the Federal Reserve, which is the

Q190: Fill in the table below with the

Q191: Suppose the market for loanable funds is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents