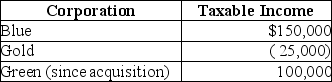

Blue and Gold Corporations are members of the Blue-Gold affiliated group, which filed a consolidated tax return for last year, reporting a $200,000 consolidated NOL. Small taxable income amounts were reported by Blue and Gold in separate tax returns filed in years prior to last year. Early in the current year, 100% of Blue's stock is purchased by Robert Martin who contributes additional funds to Blue Corporation sufficient to acquire all of Green Corporation's stock. For the current year, the affiliated group reports the following results (excluding the consolidated NOL deduction) :  Which of the following statements is correct?

Which of the following statements is correct?

A) Last year's NOL cannot be carried back.

B) The portion of last year's NOL that is not used as a carryback can be carried over the current year but is only used against Blue's taxable income.

C) The portion of last year's NOL that is not used as a carryback can be carried over against the current consolidated taxable income, but is subject to the Sec. 382 limitation.

D) The portion of last year's NOL that is not used as a carryback can be carried over, but is used only against the Blue's and Gold's taxable income.

Correct Answer:

Verified

Q66: A consolidated 2018 NOL carryover is $36,000

Q72: Jason and Jon Corporations are members of

Q75: What is the consequence of having losses

Q76: P and S comprise an affiliated group

Q77: Boxcar Corporation and Sidecar Corporation, an affiliated

Q78: Key and Glass Corporations were organized in

Q79: Identify which of the following statements is

Q84: Which of the following intercompany transactions creates

Q85: A consolidated return's tax liability is owed

Q86: An advantage of filing a consolidated return

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents