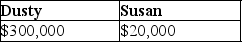

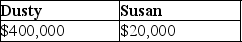

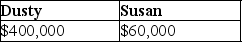

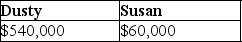

Dusty Corporation owns 90% of Palace Corporation's stock and Susan owns the remaining stock. Dusty Corporation's stock basis is $300,000 and Susan's stock basis is $20,000. Under a plan of complete liquidation, Dusty Corporation receives property with a $400,000 adjusted basis and a $540,000 FMV and Susan receives property with a $20,000 adjusted basis and a $60,000 FMV. The bases of the properties are:

A)

B)

C)

D)

Correct Answer:

Verified

Q30: Albert receives a liquidating distribution from Glidden

Q39: Under the general liquidation rules, Missouri Corporation

Q41: Cowboy Corporation owns 90% of the single

Q42: When a subsidiary corporation is liquidated into

Q43: A subsidiary must recognize depreciation recapture income

Q45: Explain the difference in tax treatment between

Q46: A subsidiary recognizes no gain or loss

Q51: Specialty Corporation distributes land to one of

Q54: Carly owns 25% of Base Corporation's single

Q59: Market Corporation owns 100% of Subsidiary Corporation's

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents