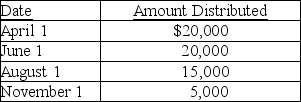

Exit Corporation has accumulated E&P of $24,000 at the beginning of the current tax year. Current E&P is $20,000. During the year, the corporation makes the following distributions to its sole shareholder who has a $22,000 basis for her stock.  The treatment of the $15,000 August 1 distribution would be

The treatment of the $15,000 August 1 distribution would be

A) $15,000 is taxable as a dividend; $5,000 from current E&P and the balance from accumulated E&P.

B) $15,000 is taxable as a dividend from accumulated E&P.

C) $4,000 is taxable as a dividend from accumulated E&P, and $11,000 is tax-free as a return of capital.

D) $5,000 is taxable as a dividend from current E&P, and $10,000 is tax-free as a return of capital.

Correct Answer:

Verified

Q1: Identify which of the following increases Earnings

Q3: Identify which of the following statements is

Q8: Current E&P does not include

A)tax-exempt interest income.

B)life

Q9: In the current year, Ho Corporation sells

Q10: Crossroads Corporation distributes $60,000 to its sole

Q11: Grant Corporation sells land (a noninventory item)with

Q13: On April 1, Delta Corporation distributes $120,000

Q15: How does a shareholder classify a distribution

Q16: Oreo Corporation has accumulated E&P of $8,000

Q18: Corporations may always use retained earnings as

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents