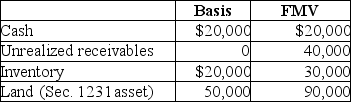

The ABC Partnership owns the following assets on December 31.  The indication that ABC owns substantially appreciated inventory is

The indication that ABC owns substantially appreciated inventory is

A) the total FMV of all assets except cash is greater than their total basis.

B) the FMV of all assets except land is $90,000 while their bases is $40,000.

C) the FMV of the inventory is $30,000 while its adjusted basis is $20,000.

D) the FMV of the inventory and unrealized receivables is $70,000 while their adjusted bases is $20,000.

Correct Answer:

Verified

Q22: The definition of "inventory" for purposes of

Q25: For Sec. 751 purposes, "substantially appreciated inventory"

Q26: The TK Partnership has two assets: $20,000

Q27: Identify which of the following statements is

Q29: Identify which of the following statements is

Q31: Two years ago, Tom contributed investment land

Q34: For purposes of Sec. 751, inventory includes

Q36: The Internal Revenue Code includes which of

Q42: Steve sells his 20% partnership interest having

Q48: Ten years ago, Latesha acquired a one-third

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents