Before receiving a liquidating distribution, Kathy's basis in her interest in the KLM Partnership is $30,000. The distribution consists of $5,000 in money, inventory having a $1,000 basis to the partnership and a $2,000 FMV, and two parcels of undeveloped land (not held as inventory) having basis of $3,000 and $9,000 to the partnership with FMVs of $5,000 and $12,000, respectively. What is Kathy's basis in each parcel of land?

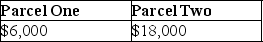

A)

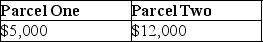

B)

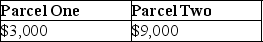

C)

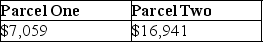

D)

Correct Answer:

Verified

Q44: Identify which of the following statements is

Q45: Identify which of the following statements is

Q46: The sale of a partnership interest always

Q50: Do most distributions made by a partnership

Q51: Ed receives a $20,000 cash distribution from

Q54: Identify which of the following statements is

Q54: The CHS Partnership's balance sheet presented below

Q57: A partner can recognize gain, but not

Q58: Eicho's interest in the DPQ Partnership is

Q59: Identify which of the following statements is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents