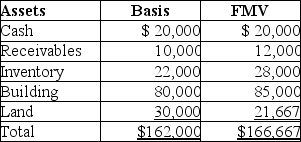

The LM Partnership terminates for tax purposes on July 15 when Latasha sells her 60% capital and profits interest to Zoe for $100,000. The partnership has no liabilities, and its assets at the time of termination are as follows:  Marika, a 40% partner in the LM Partnership, has a $64,800 basis in her partnership interest (outside basis) at the time of the termination. She has held her LM Partnership interest for three years at the time of the termination. The basis of Marika and Zoe in the new LM Partnership is:

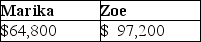

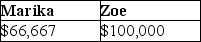

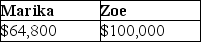

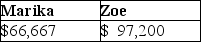

Marika, a 40% partner in the LM Partnership, has a $64,800 basis in her partnership interest (outside basis) at the time of the termination. She has held her LM Partnership interest for three years at the time of the termination. The basis of Marika and Zoe in the new LM Partnership is:

A)

B)

C)

D)

Correct Answer:

Verified

Q84: The AB, BC, and CD Partnerships merge

Q85: When must a partnership make mandatory basis

Q86: A partnership terminates for federal income tax

Q88: Sally is a calendar-year taxpayer who owns

Q89: Sean, Penelope, and Juan formed the SPJ

Q90: Which of the following is a valid

Q91: The STU Partnership, an electing Large Partnership,

Q94: Which of the following statements is correct?

A)A

Q97: Rod owns a 65% interest in the

Q100: Identify which of the following statements is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents