Carver Lumber sells lumber and general building supplies to building contractors in a medium-sized town in Montana. Data regarding the store's operations follow: Sales are budgeted at $350,000 for November, $320,000 for December, and $300,000 for January.

Collections are expected to be 90% in the month of sale and 10% in the month following the sale.

The cost of goods sold is 75% of sales.

The company desires to have an ending merchandise inventory equal to 60% of the following month's cost of goods sold. Payment for merchandise is made in the month following the purchase.

Other monthly expenses to be paid in cash are $24,700.

Monthly depreciation is $16,000.

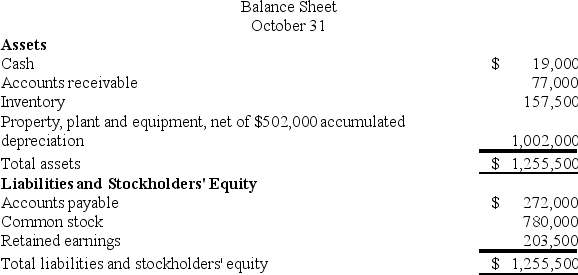

Ignore taxes. Retained earnings at the end of December would be:

Retained earnings at the end of December would be:

A) $289,600

B) $296,000

C) $236,400

D) $203,500

Correct Answer:

Verified

Q209: Varughese Inc. is working on its cash

Q210: Vinall Corporation makes one product and has

Q211: Porter Corporation makes and sells a single

Q212: The Bandeiras Corporation, a merchandising firm,

Q213: Tilson Corporation has projected sales and production

Q215: The Bandeiras Corporation, a merchandising firm,

Q217: Porter Corporation makes and sells a single

Q219: Varughese Inc. is working on its cash

Q248: Bries Corporation is preparing its cash budget

Q260: Craney Corporation makes one product and it

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents