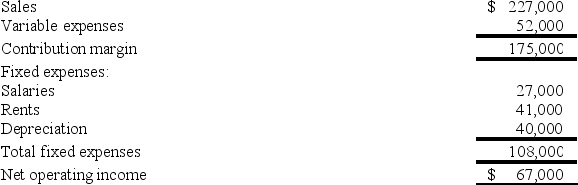

Olinick Corporation is considering a project that would require an investment of $343,000 and would last for 8 years. The incremental annual revenues and expenses generated by the project during those 8 years would be as follows (Ignore income taxes.) :  The scrap value of the project's assets at the end of the project would be $23,000. The cash inflows occur evenly throughout the year. The payback period of the project is closest to:

The scrap value of the project's assets at the end of the project would be $23,000. The cash inflows occur evenly throughout the year. The payback period of the project is closest to:

A) 3.0 years

B) 5.1 years

C) 3.2 years

D) 4.8 years

Correct Answer:

Verified

Q1: The internal rate of return is the

Q3: The minimum required rate of return is

Q4: The payback method is most appropriate for

Q6: Discounted cash flow techniques automatically take into

Q13: If the salvage value of equipment at

Q14: When a company is cash poor, a

Q21: The simple rate of return is computed

Q23: The Zingstad Corporation is considering an investment

Q24: In calculating the "investment required" for the

Q48: The internal rate of return method assumes

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents