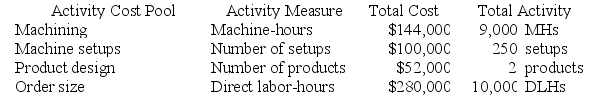

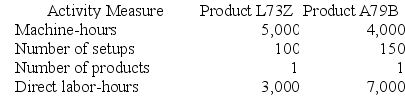

Losser Corporation manufactures two products: Product L73Z and Product A79B. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products L73Z and A79B.

Required:

Required:

a. Using the plantwide overhead rate, how much manufacturing overhead cost would be allocated to Product L73Z?

b. Using the plantwide overhead rate, how much manufacturing overhead cost would be allocated to Product A79B?

c. Using the ABC system, how much total manufacturing overhead cost would be assigned to Product A79B?

d. Using the plantwide overhead rate, what percentage of the total overhead cost is allocated to Product L73Z?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q183: Aresco Corporation manufactures two products: Product G51B

Q184: Kretlow Corporation has provided the following data

Q185: Beckley Corporation has provided the following data

Q186: Boudoin Corporation manufactures two products: Product T72T

Q187: Hagy Corporation has an activity-based costing system

Q189: EMD Corporation manufactures two products, Product S

Q190: Dane Housecleaning provides housecleaning services to its

Q191: Clenney Corporation uses a plantwide overhead rate

Q192: Ciulla Corporation manufactures two products: Product J12N

Q193: Howell Corporation's activity-based costing system has three

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents