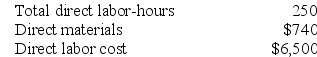

Mcewan Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on 20,000 direct labor-hours, total fixed manufacturing overhead cost of $182,000, and a variable manufacturing overhead rate of $2.50 per direct labor-hour. Job X941, which was for 50 units of a custom product, was recently completed. The job cost sheet for the job contained the following data:

Required:

Required:

Calculate the selling price for Job X941 if the company marks up its unit product costs by 20%.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q238: Linnear Corporation uses a job-order costing system

Q239: Kroeker Corporation has two production departments, Milling

Q240: Petty Corporation has two production departments, Milling

Q241: Luarca Corporation has two manufacturing departments--Casting and

Q242: Mccaughan Corporation bases its predetermined overhead rate

Q244: Lightner Corporation bases its predetermined overhead rate

Q246: Lamberson Corporation uses a job-order costing system

Q247: Trevigne Corporation uses a predetermined overhead rate

Q322: Weakley Corporation uses a predetermined overhead rate

Q400: Moscone Corporation bases its predetermined overhead rate

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents