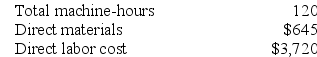

Saxon Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on 10,000 machine-hours, total fixed manufacturing overhead cost of $91,000, and a variable manufacturing overhead rate of $2.40 per machine-hour. Job K373, which was for 60 units of a custom product, was recently completed. The job cost sheet for the job contained the following data:

Required:

Required:

a. Calculate the estimated total manufacturing overhead for the year.

b. Calculate the predetermined overhead rate for the year.

c. Calculate the amount of overhead applied to Job K373.

d. Calculate the total job cost for Job K373.

e. Calculate the unit product cost for Job K373.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q274: Amason Corporation has two production departments, Forming

Q275: Carcana Corporation has two manufacturing departments--Machining and

Q276: Kluth Corporation has two manufacturing departments--Molding and

Q277: Dancel Corporation has two production departments, Milling

Q278: Dietzen Corporation has two manufacturing departments--Casting and

Q280: Petru Corporation uses a job-order costing system

Q281: Bulla Corporation has two production departments, Machining

Q282: Marius Corporation has two production departments, Casting

Q283: Gercak Corporation has two production departments, Forming

Q284: Job 243 was recently completed. The following

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents