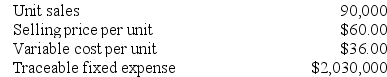

Saulsberry Corporation manufactures numerous products, one of which is called Beta70. The company has provided the following data about this product:

Required:

Required:

a. What net operating income is the company earning now on its sales of Beta70?

b. Management is considering increasing the price of Beta70 by 10%, from $60.00 to $66.00. The company's marketing managers estimate that this price hike would decrease unit sales by 15%, from 90,000 units to 76,500 units. Assuming that the total traceable fixed expense does not change, what net operating income will Beta70 earn at a price of $66.00 if this sales forecast is correct?

c. Assuming that the total traceable fixed expense does not change, how many units of Beta70 would Saulsberry need to sell at a price of $66.00 to earn the same net operating income that it currently earns at a price of $60.00? (Round your answer up to the nearest whole number.)

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q135: Ritner Corporation manufactures a product that has

Q136: Hill Corporation is contemplating the introduction of

Q137: Yashinski Corporation manufactures numerous products, one of

Q138: Gildersleeve Corporation manufactures a product that has

Q144: Management of Thebeau,Inc.,is considering a new product

Q149: Weakly Industrial Products Inc.has developed a new

Q397: Bohmker Corporation is introducing a new product

Q405: Lodholz Corporation would like to use target

Q410: Gama Avionics Corporation has developed a new

Q416: Management of Niemczyk Corporation is considering a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents